Innovative UPI Solutions for Every User, Business & NRI

From AI-powered bill management to global UPI transfers, RupeeFlow is redefining how India pays, saves, and manages finances — all through one unified platform.

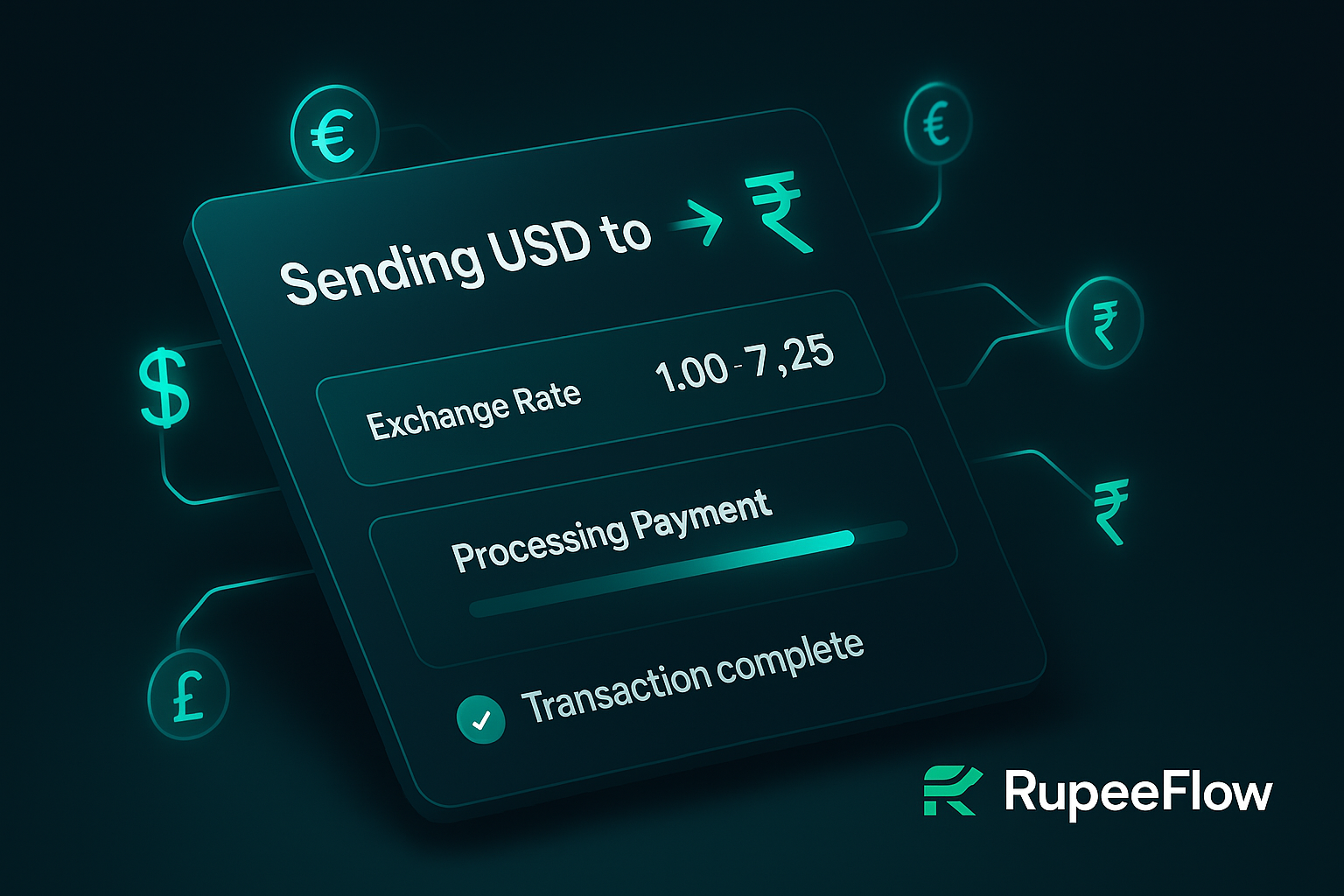

Cross-Border UPI for NRIs

Pay Indian bills directly from your foreign bank accounts using international UPI.

Real-time forex conversion

Secure remittance

Family delegated payments

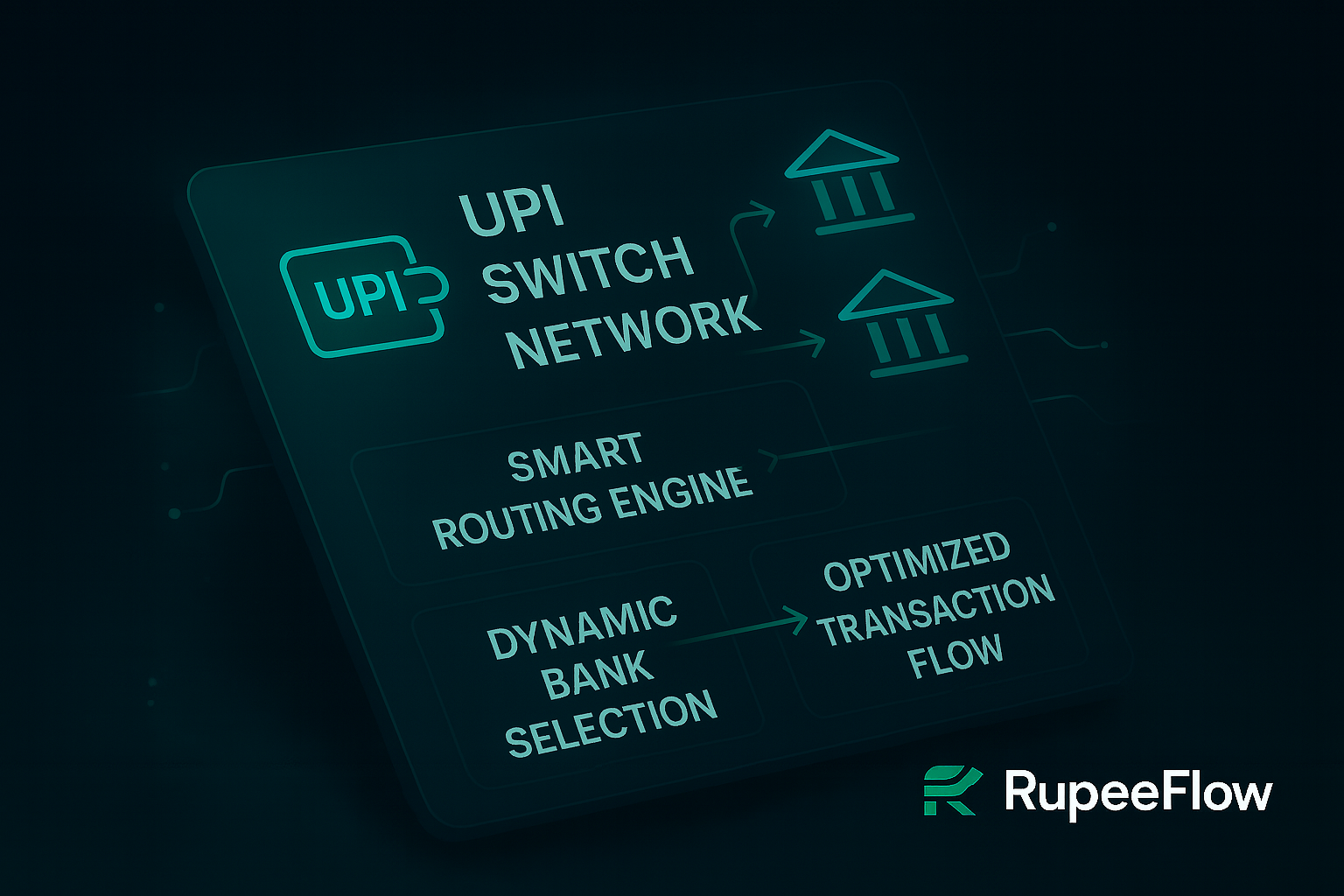

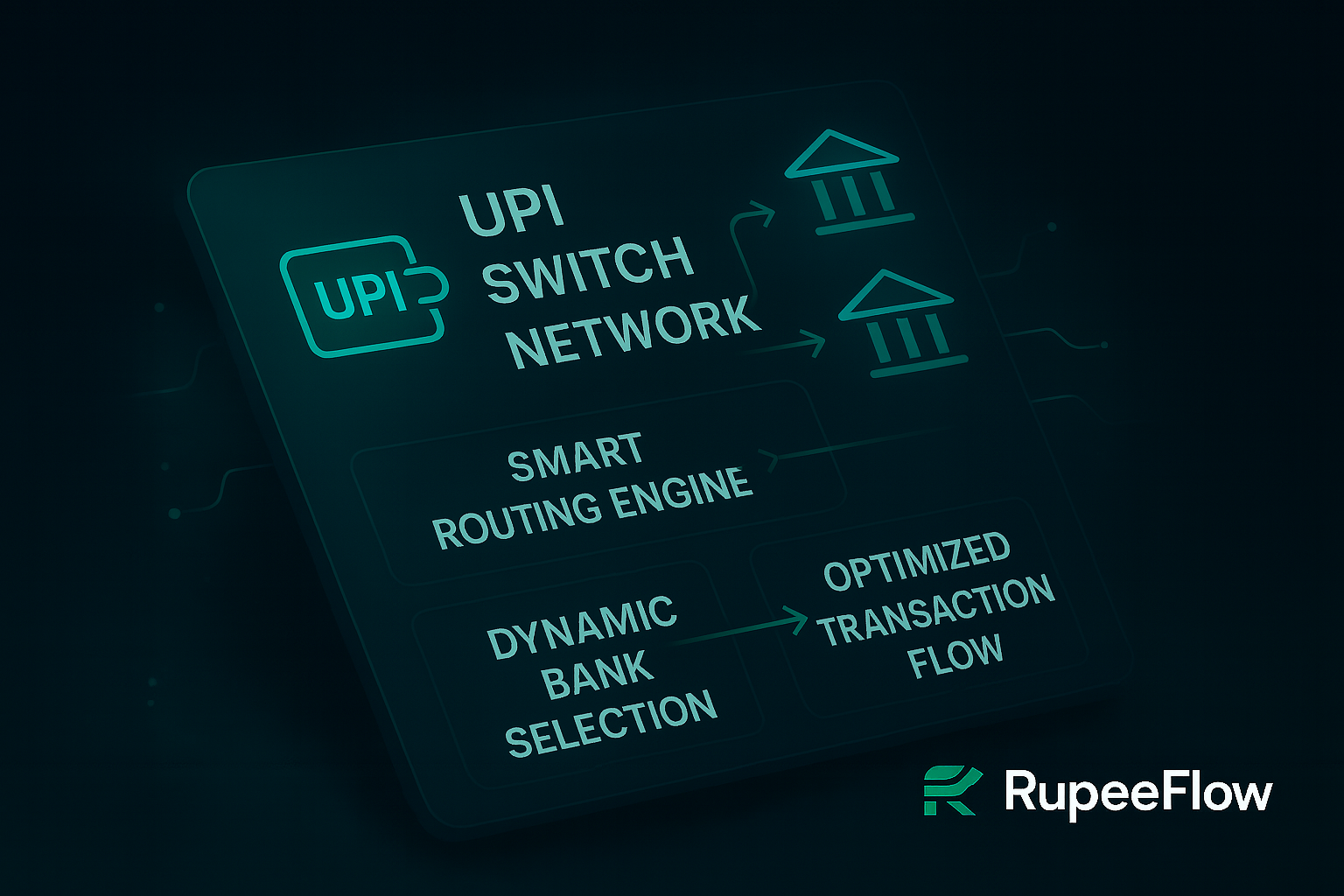

Intelligent UPI Switch

RupeeFlow’s AI-powered UPI Switch ensures seamless cross-bank routing, real-time optimization, and unmatched reliability for every transaction.

Dynamic transaction routing

AI-based load balancing

99.99% uptime & resilience

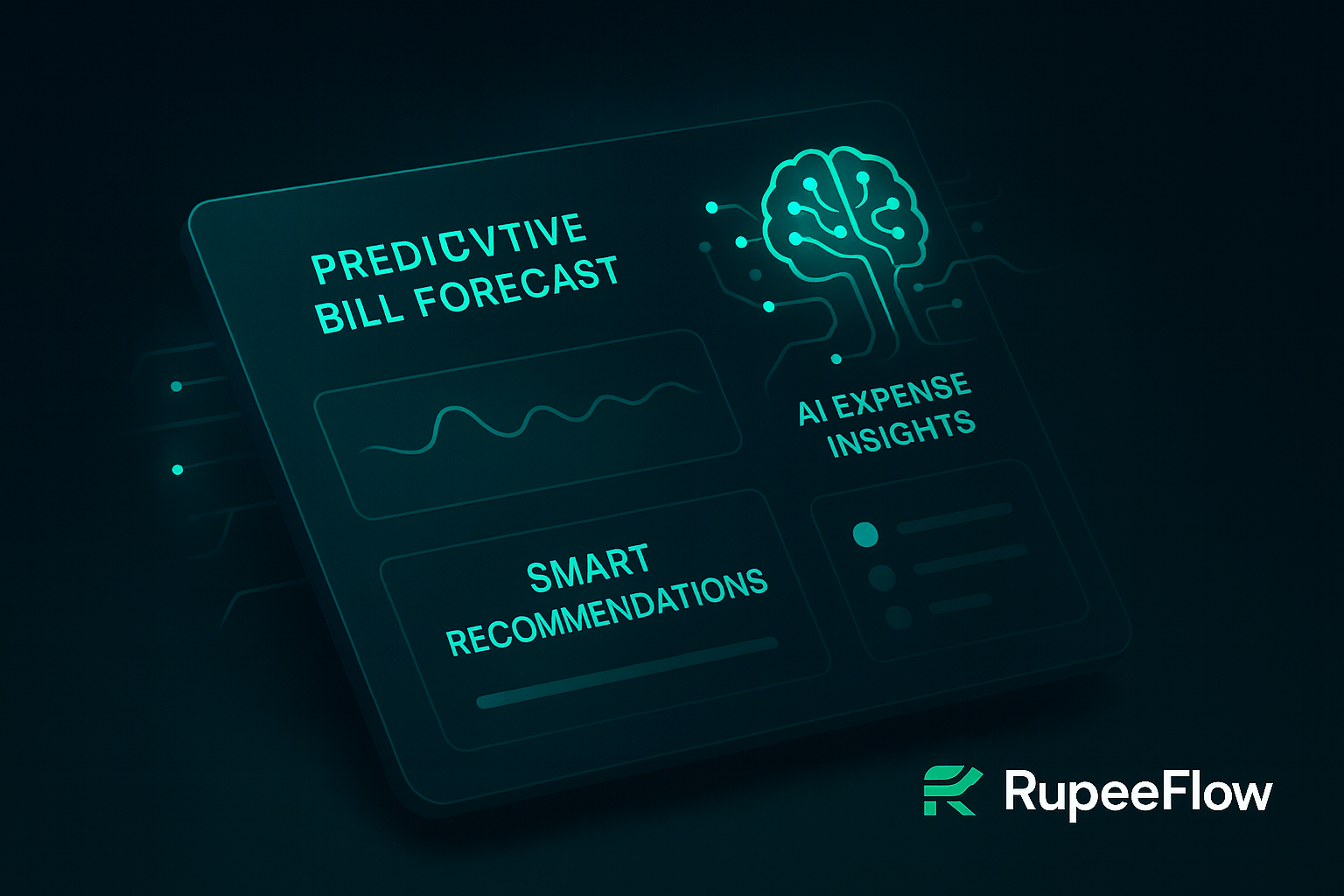

AI-Powered Bill Management

Automate bill tracking, reminders, and insights with our advanced AI engine.

Predictive analytics

Smart alerts

Expense optimization

Smart Wallet for Gig Workers

Simplify finances with automated payments and instant access to micro-loans.

Bill auto-pay

One-tap withdrawals

Savings goals

Fraud Resilient UPI Security

Protect your transactions with blockchain verification and real-time alerts.

2FA & biometrics

Blockchain verification

Fraud alerts

Empowering Bharat’s Small Businesses with

RupeeFlow Kirana

The first offline-first UPI POS Lite app for small merchants, kirana stores, and tea stalls. Accept payments anytime even without internet, with voice, QR, and NFC. Built for Bharat’s 60M+ small vendors.

NEFT Payment API — Reliable Bank Transfers, Simplified

Empower your platform with seamless NEFT capabilities — manage high-volume transfers with RupeeFlow’s intelligent payment routing, analytics, and compliance-first API infrastructure.

24×7 NEFT Transfers

Send and receive payments anytime — no banking hours, no cut-offs.

Lightning-Fast Settlements

RupeeFlow ensures optimized NEFT processing with near-instant clearing times.

Seamless Integration

Easily connect RupeeFlow APIs with your platform using well-documented SDKs, sandbox environments, and developer-first support.

Secure & Compliant

Every transaction is encrypted, verified, and processed under RBI and NPCI norms.

Automated Reconciliation

Access downloadable transaction logs, receipts, and full settlement reports.

Smart Payment Insights

AI-driven analytics to monitor success rates, performance, and trends in real time.

IMPS — Instant Money Transfer API

Power your business with lightning-fast IMPS transfers using RupeeFlow’s secure, RBI-compliant API. Automate payouts, offer real-time settlements, and manage instant interbank payments with ease.

Instant Transfers

Enable real-time interbank payments with RupeeFlow’s IMPS-powered network.

24×7 Availability

Never miss a transaction window — IMPS APIs run continuously with instant settlements.

Bank-Grade Security

Encrypted IMPS channels ensure every transfer meets RBI and NPCI compliance standards.

Smart Analytics

Gain insights into transfer success rates and transaction trends with RupeeFlow’s dashboard.

Developer Friendly

Easily integrate with RESTful APIs, sandbox testing, and webhooks for status tracking.

Automated Payouts

Simplify vendor and salary disbursements with automated IMPS payouts in bulk.

Powering the Future of UPI Infrastructure

RupeeFlow’s UPI Switch is designed to handle high-volume transactions with intelligent routing, real-time monitoring, and AI-powered optimization, ensuring every payment succeeds, instantly.

Explore UPI Switch

Smarter Routing

Optimize every transaction path for maximum speed and success rates with AI-assisted routing.

Peak-Time Reliability

Handle high transaction volumes seamlessly during load surges and festive spikes.

Bank-Grade Security

All transfers are secured with advanced encryption and RupeeFlow’s fraud-resilient infrastructure.

AI-Powered Optimization

Real-time monitoring and predictive rerouting ensure performance and uptime at scale.

Verification APIs — Simple, Fast & Reliable

Verify user identities in seconds using RupeeFlow’s intelligent verification APIs. Reduce fraud, speed up onboarding, and ensure full compliance with secure government data sources.

Aadhaar Verification

Verify users instantly with Aadhaar-based authentication — ensuring secure and compliant onboarding with verified identity data.

PAN Verification

Enable instant PAN verification to validate tax information and eliminate fraudulent account creation using RupeeFlow’s API.

Voter ID Verification

Authenticate voter identities in real-time to meet KYC and compliance requirements with accurate government-backed data.

AEPS — Aadhaar Enabled Payment System

Empower your business with seamless Aadhaar-enabled transactions, cash withdrawals, and micro-ATM access — built with RupeeFlow’s secure fintech infrastructure.

Biometric Transactions

Seamless Aadhaar-based authentication for withdrawals and balance checks.

Micro ATM Integration

Accept cash deposits, withdrawals, and mini statements with ease.

Instant Settlement

Faster payouts and transparent reconciliation powered by RupeeFlow AI.

Secure by Design

End-to-end encryption and fraud detection using blockchain verification.

One App, All Access

Enable AEPS services directly from your RupeeFlow dashboard or API.

Domestic Money Transfer (DMT)

Power your fintech or platform with instant domestic transfers across 400+ banks — secure, fast, and fully compliant.

Real-Time Transfers

Enable IMPS & NEFT transfers with lightning-fast settlements and 24/7 availability.

Secure & Compliant

Robust KYC & fraud protection built-in with RBI and NPCI standards compliance.

Instant Activation

Simple integration with our RESTful API — start serving customers in hours, not days

Expand your reach with instant DMT services

Offer customers secure money transfers anytime, anywhere — with RupeeFlow’s DMT API integration designed for speed and scalability.

Learn More About DMTFrequently Asked

Questions

Explore our FAQ section to find answers about RupeeFlow’s financial solutions.